In opening remarks for the RM of Wallace-Woodworth Financial Plan presentation, Reeve Clayton Canart explained that operations in the municipality were impacted by unusual weather and high fuel prices.

Based upon the general mill rate, property taxes in Wallace-Woodworth will go up a small amount, 0.10 mills, for ratepayers.

The reeve said, “Council’s goal in 2022 was to keep the same level of spending in our budget. However, the Municipality was not spared from inflationary costs and market uncertainties.” He pointed out that the spring snowstorms added an increase in operating expenses in the first quarter, as well as the continued COVID-19 impacts and the inflation on fuel prices. “Due to these unforeseen circumstances, the municipal mill rate reflects a minimal increase which is still far from where we have been since 2015.”

Chief Administrative Officer Garth Mitchell, through a PowerPoint presentation, provided citizens with budget specifics.

Tracking the General mill rate, it was much higher seven budgets ago. The rate was 19.703 in 2015 and by 2019 it was lowered to 14.758. When COVID-19 hit in 2020 there was a further drop to 11.55, then to 10.749 in 2021 budget.

For 2022 the mill rate was set at 10.849 for a balanced budget.

In 2022, one mill equals $460,855.42. That’s about $618 less than the value of a mill in 2021 and it’s directly related to assessment: the At Large assessment for 2021 was $ 461,473,850; in 2022 the At Large assessment was $ 460,855,420 representing a drop of 0.13%

The municipality continues to carry a large surplus. As of December 31, 2020 the audited nominal surplus was $ 9,725,480. The 2021 surplus is still in the process of being audited.

Wallace-Woodworth has what CAO Mitchell terms “a reasonable cash position from which to operate.” The surplus is mainly due to oil revenues that exceeded their budgeted projections, but some of the surplus comes from unspent, but budgeted project monies from previous years.

A ratepayer at the meeting questioned why the mill rate would rise at all when the municipality is running some millions of surplus.

The pitch for running this “healthy” surplus – it’s a safety net to avoid sudden changes in the mill rate if there’s a change in assessment, and some surplus has been used to that end in previous years. The surplus could also enable the municipality to pay bills in years when ratepayers may struggle to pay property taxes.

There are three wards in the municipality. While the At Large assessment was down slightly (0.13%), Ward 1 (formerly Woodworth) was up by .33 %; Ward 2 (formerly Wallace minus Elkhorn) was down by .33 % and Ward 3 (Elkhorn) assessment rose by 0.76 %. Kenton, as an LUD, was assessed 0.21 % higher.

Roads are always a public concern. The reserve fund for roads of $1.071M receives up to 50 % of the revenue that comes to the RM from oil royalties, mineral leases, surface oil leases, to a maximum of $750,000, annually.

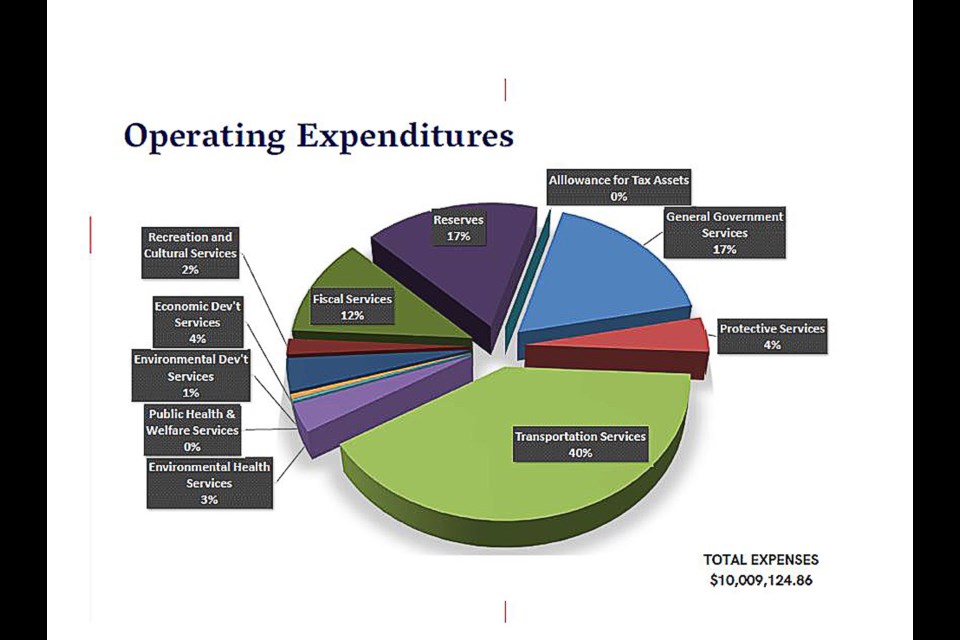

Municipal income includes Taxes and Grants in Lieu $5,567,825.38; Oil Revenue of $500,000; Provincial and Federal Grants of $471,949.24; Transfer from Reserves and Surplus of $2,536,500; Other Revenue $ 932,850.24 for a total budgeted income of $10,009,124.86 which is balanced by budgeted operating costs of the same.

Surplus Fund transfers of $1.78 M included a total of $840,000 that was budgeted to 16 different areas in 2021 but unspent. Other surplus transfers were from the Ward 2 Shop fund of $700,000 and a fund of $240,000 designated to buffer mill rate increases.

Capital purchases totalling $1.954M budgeted for 2022 include machinery such as four quick attach units for $109,500, a road groomer for $15,500, a mulcher for $50,000, a used wheel loader for $200,000 plus other items.

Other capital expenses will include a Ward 2 shop for $900,000; a transfer station for $600,000 and the RM’s share of upgrades to the Virden library at $20,000.

The 2022 Financial Plan is available at Wallace-Worth.com under Council, downloads and documents.

Nearly 20 ratepayers attended the meeting in the Elkhorn Elks Hall on May 5. It was a record crowd by comparison with recent years.